News

Keep up with latest industry and accounting news here.

Press Releases

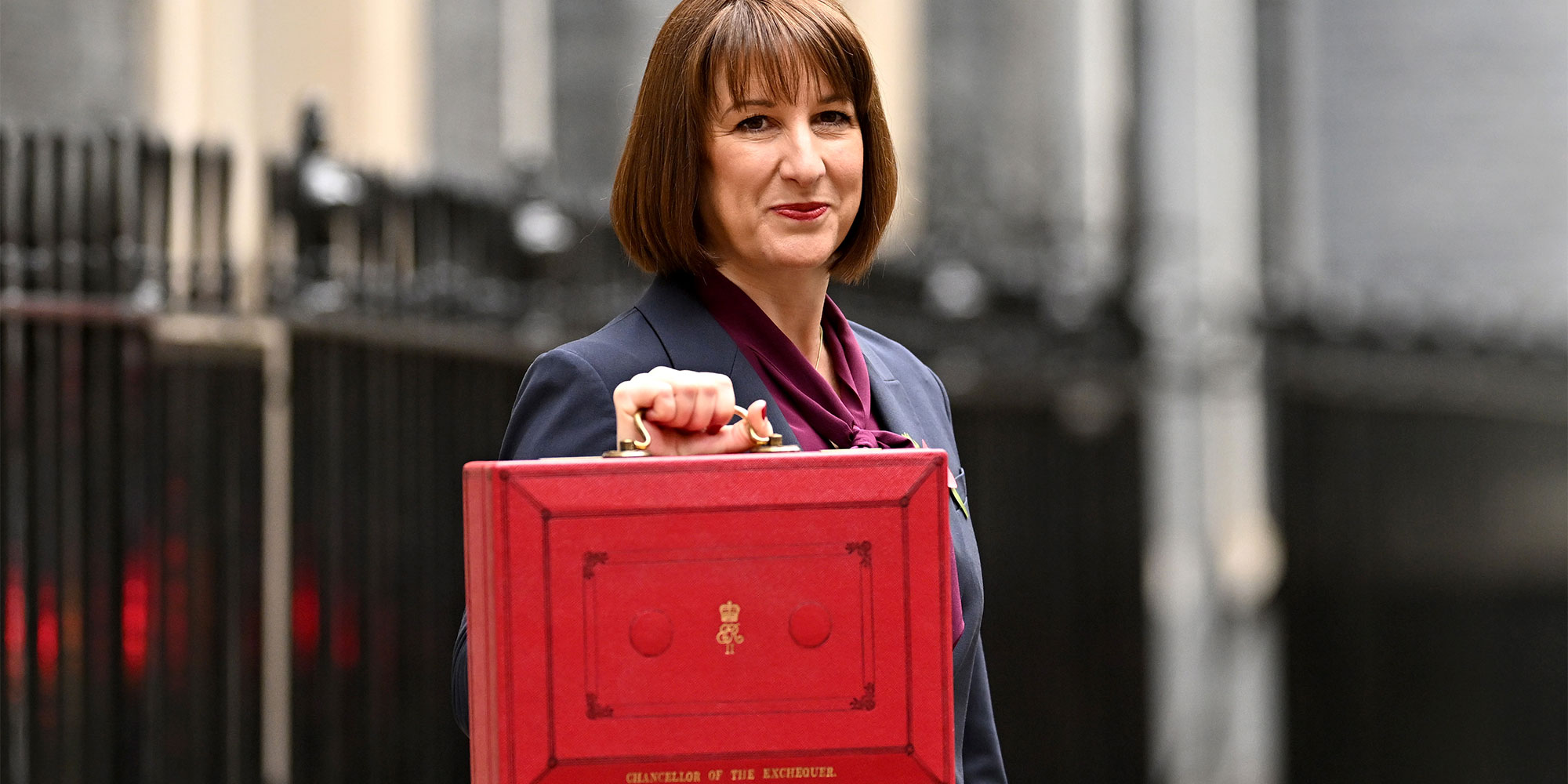

Press Release: Autumn Statement 2026

26

November

2025

Toast Accountants is calling on Northern Ireland’s SMEs to take decisive action following today’s UK Budget, warning that while the Chancellor’s announcements are positioned as part of a UK-wide fiscal strategy, their effects will be felt more heavily in Northern Ireland.

Today’s Budget delivers another round of fiscal tightening, said to be aimed at balancing the country’s books; however, for Northern Ireland’s SMEs, the implications are deeper, sharper, and more immediate than the headline statements suggest. While the Chancellor’s measures apply across the UK, their effects land differently here.

The rise in the National Minimum Wage brings the biggest challenge. This rise follows continued increases in the National Minimum Wage and Employers’ National Insurance contributions in recent years. In 2017, the minimum wage rate for adults was £7.50/hr. By April 2026, the adult rate will rise to £12.71/hr. This change represents a 70% cumulative increase in the minimum wage over eight years, well above the projected cumulative 40%inflation increase over the same period. Once again, NI’s hospitality, retail, social care and service-based businesses will face significant cost increases. The Budget offers no compensatory measures to help local employers absorb the impact or invest in productivity improvements.

The Government is placing more of the burden on the shoulders of Business Owners

In short, the Government is placing more of the burden on the shoulders of Business owners,” said Michael Rutherford, Partner at Toast Accountants. “Higher wage costs, increased Employer’s National Insurance and frozen thresholds add up fast. Our message is simple: don’t wait to feel the pressure. Understand it now and put the right structures in place."

The continued freeze on income-tax thresholds will quietly increase the tax burden on owner-managers and senior staff as wages rise. In regions with higher average incomes, the impact is softened. In Northern Ireland, where earnings are typically lower, the squeeze is more pronounced. For many SMEs, this will force a rethink of remuneration strategies sooner rather than later.

At the same time, the Budget’s focus on tightening pension rules, wealth-related taxes, and property-based reliefs adds new layers of complexity for business owners who often straddle personal and commercial financial decisions.

NI entrepreneurs already operate in a regulatory landscape shaped by both UK-wide legislation and the unique post-Brexit arrangements affecting local trade and investment. The Budget’s changes intensify that complexity without offering clear guidance or long-term stability.

"Businesses here have a track record of outperforming expectations, even in tougher conditions,” adds Steven Kivelehan, Chartered Accountant at Toast. “While the Budget brings fresh challenges, it also creates an opportunity for SMEs to modernise, strengthen their financial systems and build a real competitive advantage. This is the moment to invest in clarity and control."

Thank you

Categories

Recent Related Posts

Back

Services

Services to meet your needs

.png)

.png)

.png)